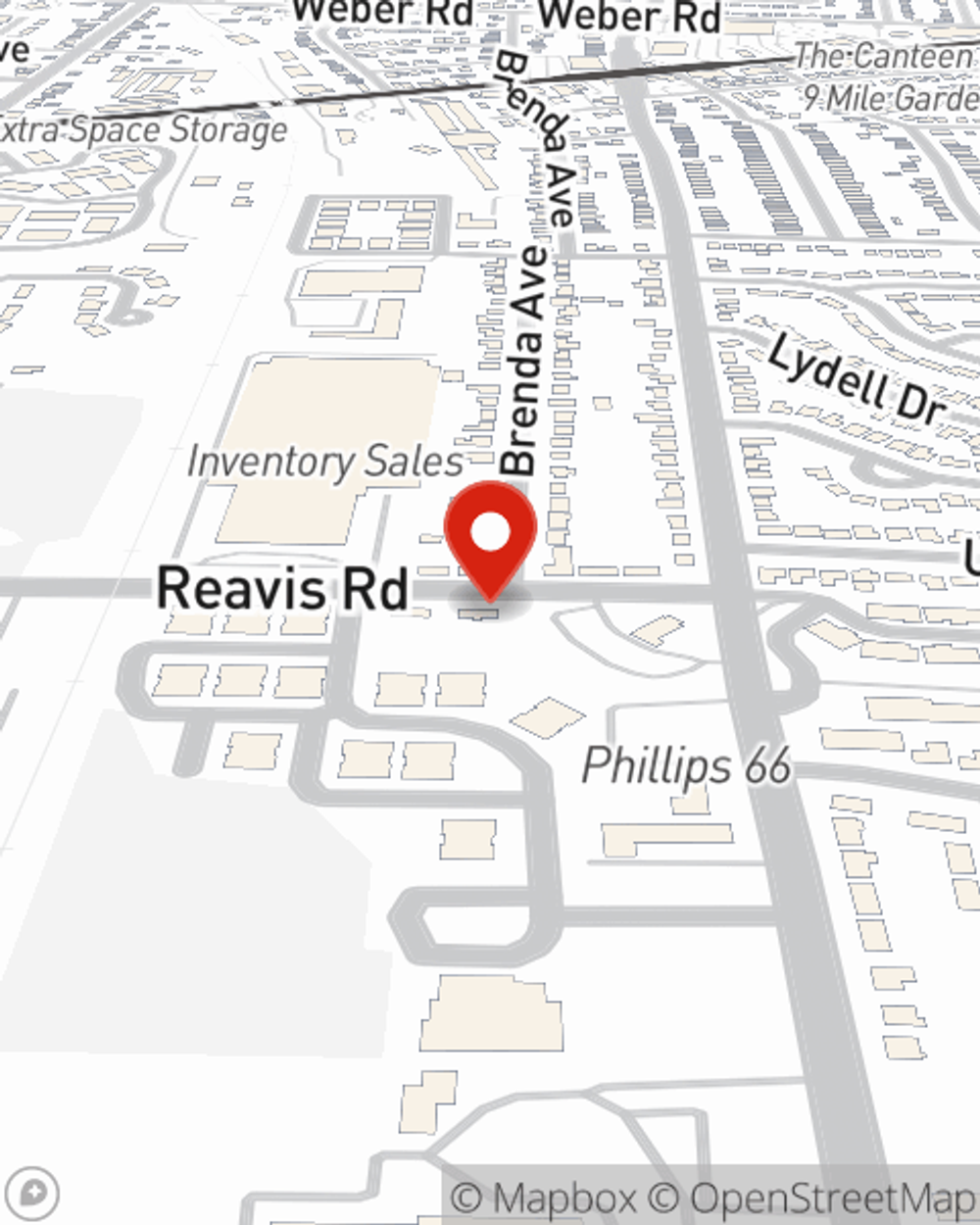

Business Insurance in and around St Louis

Looking for coverage for your business? Search no further than State Farm agent Glenn Eckert!

Almost 100 years of helping small businesses

- Affton

- Lafayette Square

- Compton Heights

- Soulard

- Fox Park

- Tower Grove East

- Down Town

- Mid Town

- Shaw

- Central West End

- Concord Village

- Crestwood

- Webster Groves

- Glendale

- Kirkwood

- Sappington

- Mehlville

- Oakville

- South County

- Jefferson County

- Nearby Illinois

Insure The Business You've Built.

You may be feeling like there is so much to do with running your small business and that you have to handle it all on your own. State Farm agent Glenn Eckert, a fellow business owner, can relate to the responsibility on your shoulders and is here to help you build a policy that's right for your needs.

Looking for coverage for your business? Search no further than State Farm agent Glenn Eckert!

Almost 100 years of helping small businesses

Protect Your Future With State Farm

State Farm has been helping small businesses grow since 1935. Business owners like you have turned to State Farm for coverage from countless industries. It doesn't matter if you are a hair stylist or an optician or you own a dental lab or a pizza parlor. Whatever your business, State Farm might help cover it with personalized policies that meet each owner's specific needs. It all starts with State Farm agent Glenn Eckert. Glenn Eckert is the person who understands where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to gather more information about your small business insurance options

When you get a policy through the reliable name for small business insurance, your small business will thank you. Get in touch with State Farm agent Glenn Eckert's team today to explore the options that may be right for you.

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Glenn Eckert

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.