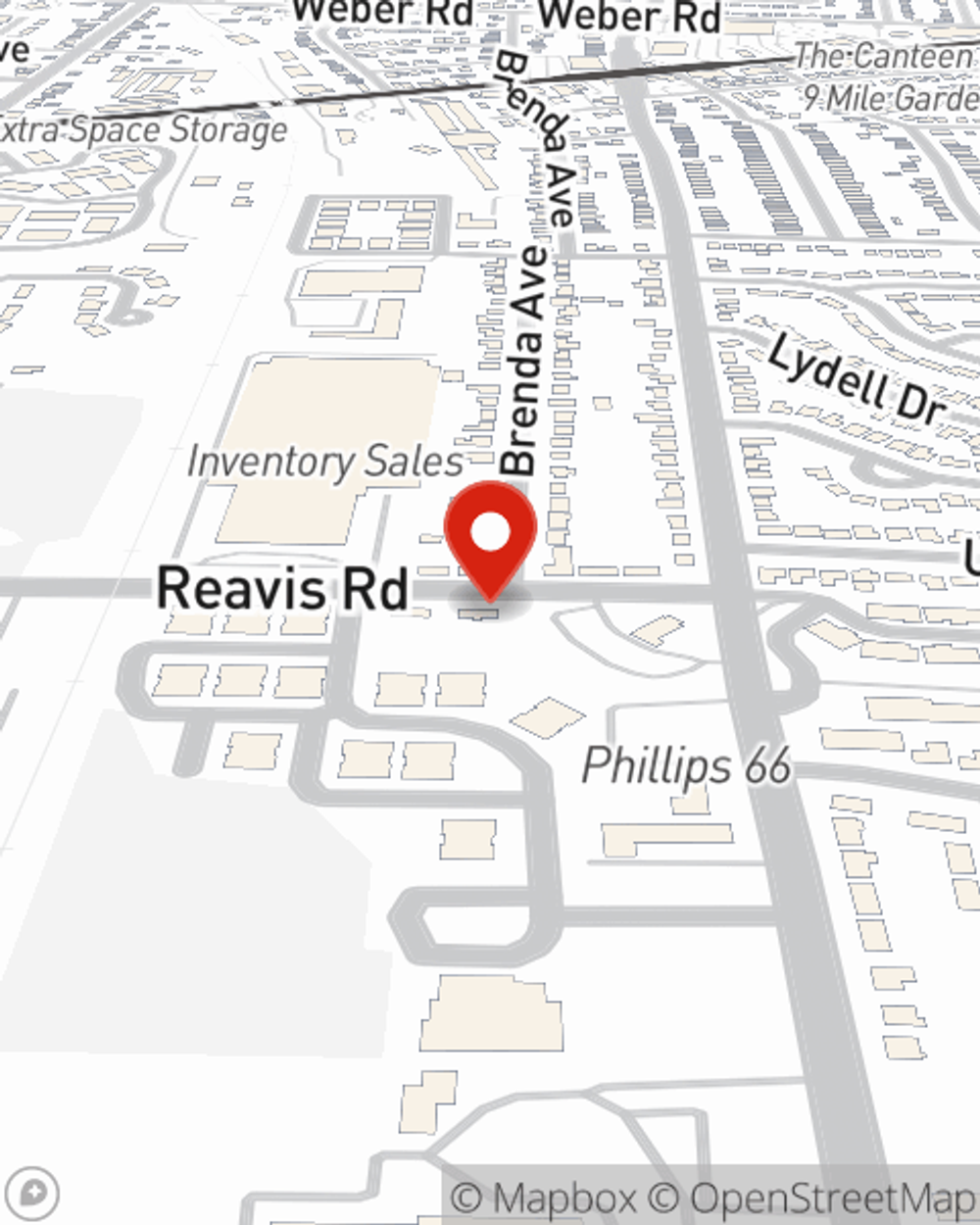

Condo Insurance in and around St Louis

Get your St Louis condo insured right here!

Quality coverage for your condo and belongings inside

- Affton

- Lafayette Square

- Compton Heights

- Soulard

- Fox Park

- Tower Grove East

- Down Town

- Mid Town

- Shaw

- Central West End

- Concord Village

- Crestwood

- Webster Groves

- Glendale

- Kirkwood

- Sappington

- Mehlville

- Oakville

- South County

- Jefferson County

- Nearby Illinois

Your Personal Property Needs Protection—and So Does Your Condo.

As with anything in life, it is a good idea to expect the unexpected and strive to prepare accordingly. When owning a condo, the unexpected could look like damage to your largest asset from theft vandalism, lightning, and other causes. It's good to be aware of these possibilities, but you don't have to fret over them with State Farm's great coverage.

Get your St Louis condo insured right here!

Quality coverage for your condo and belongings inside

Why Condo Owners In St Louis Choose State Farm

You can kick back with State Farm's Condo Unitowners Insurance knowing you are prepared for the unanticipated with dependable coverage that's right for you. State Farm agent Glenn Eckert can help you understand all the options, from liability, a Personal Price Plan® to replacement costs.

If you want to find out more information, State Farm agent Glenn Eckert is ready to help! Simply contact Glenn Eckert today and say you are interested in this terrific coverage from one of the leading providers of condo unitowners insurance.

Have More Questions About Condo Unitowners Insurance?

Call Glenn at (314) 631-5100 or visit our FAQ page.

Simple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.

Glenn Eckert

State Farm® Insurance AgentSimple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.